Congratulations!

You have successfully registered for the training. Our team of specialists will be in touch with you shortly.

Go back

Kirgizia

Kirgizia

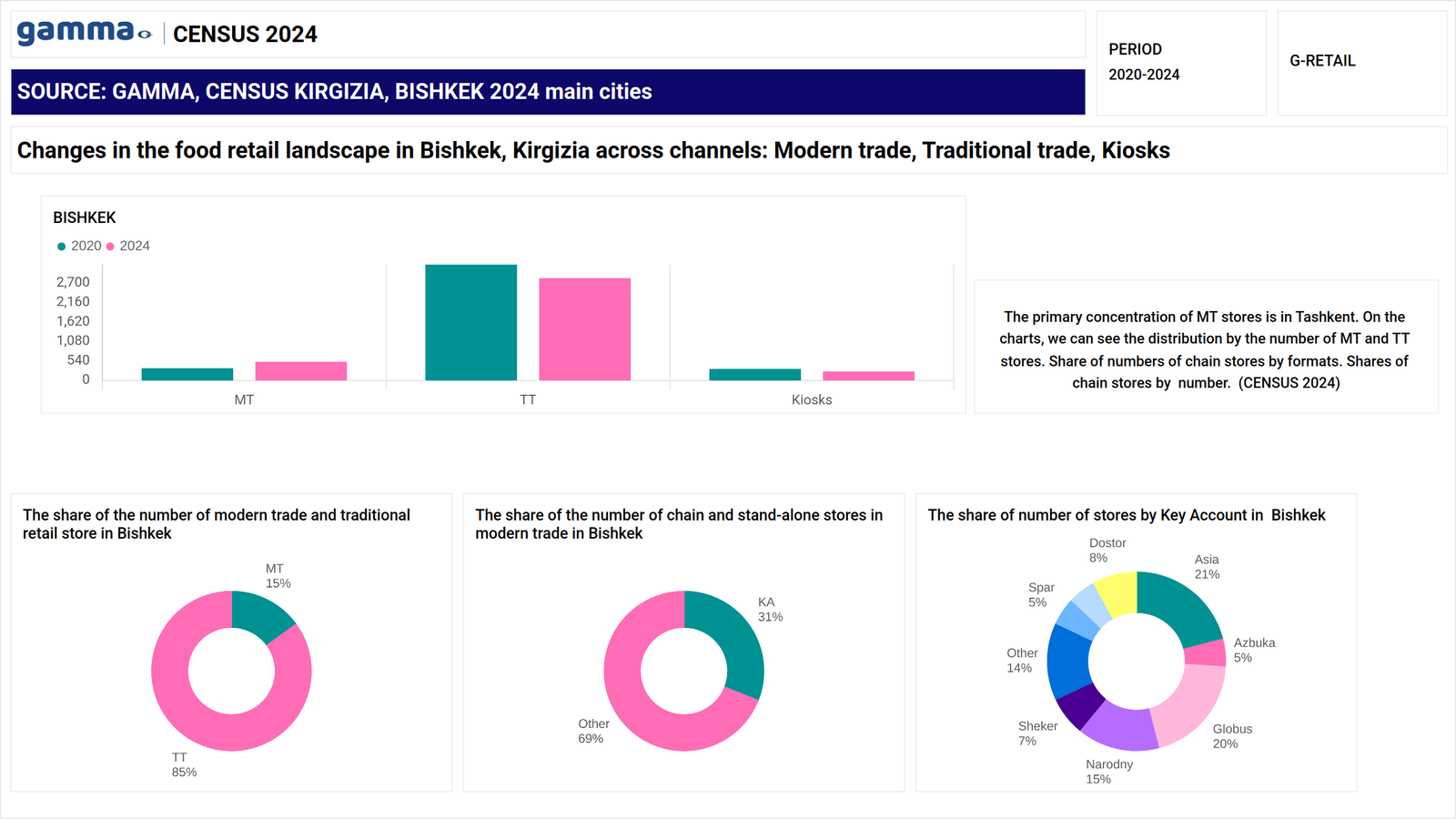

Between 2020 and 2024, the retail market in Bishkek has shown a steady trend toward modernization. While traditional trade remains dominant, there has been a noticeable decline in the absolute number of traditional shops and kiosks. At the same time, the Modern Trade (MT) segment continues to grow.

Key Channel Dynamics:

Traditional Trade (TT) still holds a significant share—85% of all retail outlets—but the number of such stores has declined compared to 2020.

Modern Trade (MT) is expanding its footprint: the number of MT outlets has grown and, by 2024, accounts for more than 15% of the total market.

Kiosks have also declined, losing share within the retail structure.

MT Formats and Structure:

All modern retail formats are present in the Bishkek market—hypermarkets, supermarkets, convenience stores, and express formats. The number of MT outlets in 2024 has nearly doubled compared to 2020, indicating active urbanization and a shift toward modern retail.

Chain stores (Key Accounts) represent 31% of MT outlets, which is a significant share for an emerging market; the remaining 69% are independent or standalone stores. It is worth noting the widespread presence of small local chains with just two or three branches.

Leading Chains by Number of Outlets:

Asia leads with 21%, followed by Globus with 20%, and Narodny—one of the market pioneers—with 15%.

Competition among chains is intensifying. The leaders—Asia and Globus—already control nearly half of the organized retail segment.

Other key players include Dostor, Sheker, and Spar, each with a share ranging from 5% to 8%.

The remaining 14% is divided among various smaller chains, indicating a fragmented market that may see future consolidation.

Based on the data, the Bishkek retail market remains largely traditional, but it is clearly entering a sustainable transition phase toward organized trade. The development of the sector is being driven by the expansion of chain formats.

Competition among local retail chains is intensifying, with several major players already operating widespread store networks across the city.

Based on data from the 2024 Retail Census conducted by GAMMA.

Uzbekistan

Uzbekistan

In 2024, our company conducted a retail census in five cities across Uzbekistan. This overview highlights the general trends observed in three of them: Tashkent, Samarkand, and Bukhara.

Read more

Armenia

Armenia

Our company has completed a census of the retail network in three major cities of Armenia: Yerevan, Gyumri, and Vanadzor. The results of the census revealed significant changes in the retail landscape of the country over the past nine years.

Read more

Georgia

Georgia

Home care products are an essential part of our daily lives.

Among these products, the importance index is highest for disinfectants, laundry detergents, soap, and dishwashing liquids, indicating that price plays a critical role in these categories.

Read more

You have successfully registered for the training. Our team of specialists will be in touch with you shortly.

Go back