Congratulations!

You have successfully registered for the training. Our team of specialists will be in touch with you shortly.

Go back

Armenia

Armenia

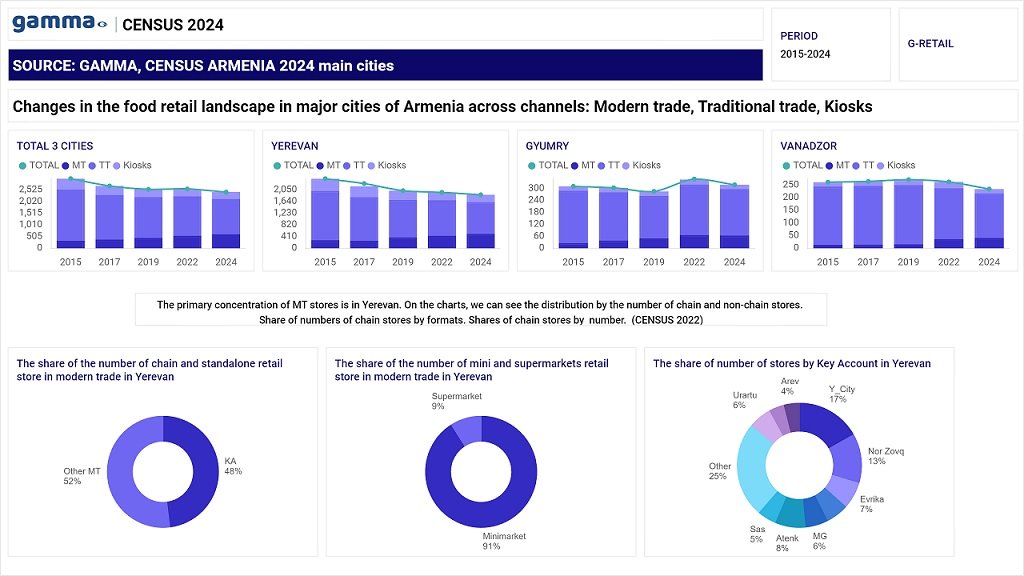

Our company has completed a census of the retail network in three major cities of Armenia: Yerevan, Gyumri, and Vanadzor. The results of the census revealed significant changes in the retail landscape of the country over the past nine years.

Decline in Retail Stores

From 2015 to 2024, there has been a consistent decline in the total number of retail outlets. The main cause for this decrease is the reduction in the number of traditional stores (TT) and kiosks, which is associated with the gradual shift of the market toward modern trade formats (MT). This trend is observed in all three cities but is especially noticeable in Yerevan, where the concentration of modern retail outlets is the highest.

Modern Trade: Leading the Market

Modern trade (MT) shows steady growth and continues to dominate Armenia’s retail market. In Yerevan, 48% of modern stores are owned by large chains (Key Account, KA), while the remaining 52% are independent stores. This highlights the high level of development of chain retail in the capital. In 2022, the share of chain stores out of the total number of modern trade outlets was slightly over 30%.

In Yerevan’s retail structure, supermarkets (up to 2500 sq. m.) occupy only 9% of the market, whereas small markets (up to 250 sq. m.) account for the overwhelming majority — 91%. Thus, the city is dominated by small stores, reflecting the strategies of local operators to focus on smaller formats.

Key Market Players

Several major chains dominate Yerevan’s market. Leading the market are chains such as Y City (17%) and Nor Zovq (13%). Other chains have smaller market shares but still make a significant contribution to the overall retail structure of the city.

Trends in Other Cities

In Gyumri and Vanadzor, there is also a steady trend toward the reduction of traditional trade formats and kiosks. Modern retail outlets in these cities maintain stable positions; however, their share is significantly lower compared to Yerevan. This indicates that the market in the regions is developing less intensively than in the capital.

Conclusion

The study reveals that Armenia’s retail sector is in the process of transitioning to modern trade formats. Yerevan remains the primary center of this transition, while the modernization trends in the regions are only starting to gain momentum.

Based on data from the 2024 Retail Census conducted by GAMMA.

Source: GAMMA, Census 2024

Armenia

Armenia

Our company has completed a census of the retail network in three major cities of Armenia: Yerevan, Gyumri, and Vanadzor. The results of the census revealed significant changes in the retail landscape of the country over the past nine years.

Read more

Georgia

Georgia

Media Consumption in Georgia is an initiative-based comprehensive study conducted as part of the “Beside 2024” project, which our company regularly implements. The goal of the study is to analyze the behavior and consumption habits of the population in relation to services and products.

Below are the key trends in media consumption across various channels.

Read more

Georgia

Georgia

Artificial intelligence (AI) has long been a key topic in high-tech and scientific research. However, despite its popularity, people’s understanding of what this term actually means varies greatly. A recent survey among Georgian citizens showed that society perceives AI in different ways, with views of technical, futuristic and ethical perspectives.

Read more

You have successfully registered for the training. Our team of specialists will be in touch with you shortly.

Go back