Congratulations!

You have successfully registered for the training. Our team of specialists will be in touch with you shortly.

Go back

Multi-country

Multi-country

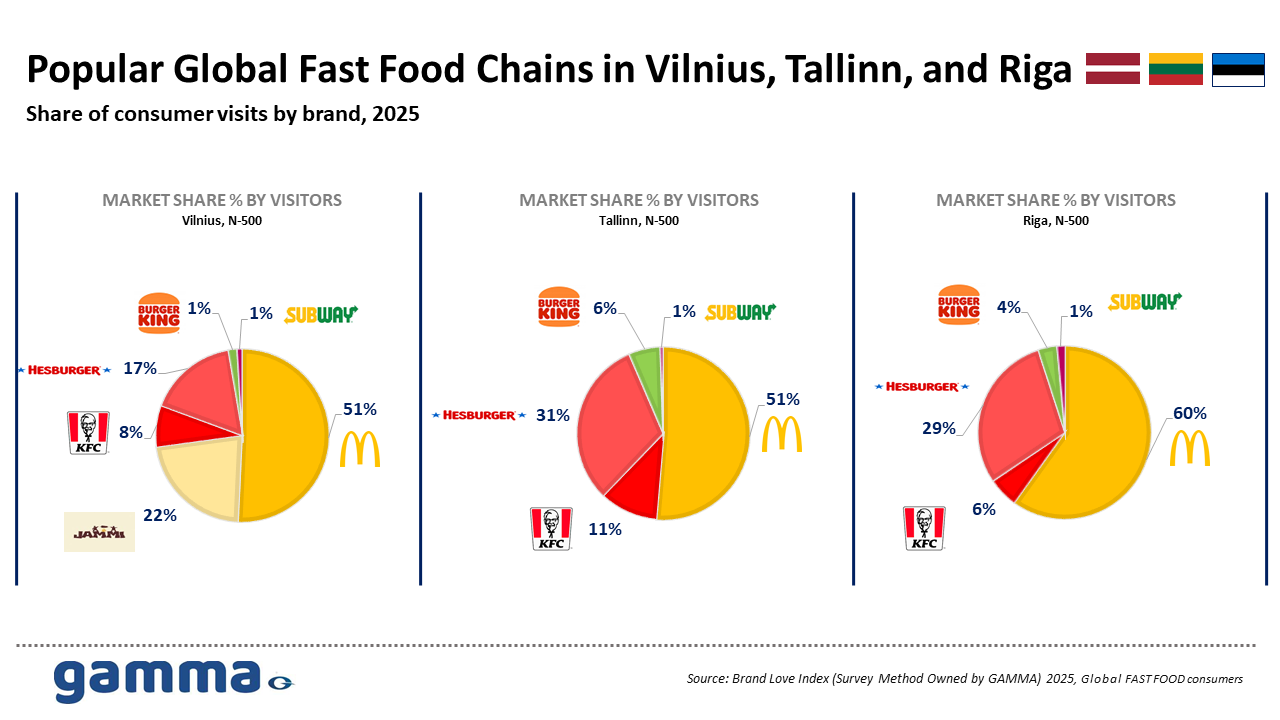

The fast food market in the Baltic countries shows similar development trends; however, each capital – Vilnius, Tallinn, and Riga – has its own structure, level of market saturation, and balance between global and local brands.

This overview is based on the results of a consumer behavior study conducted by our team, which analyzed the share of visits to major fast-food chains and identified the key motivators influencing consumer choices in the three capitals.

The study was carried out in 2025 among residents of Vilnius (Lithuania), Tallinn (Estonia), and Riga (Latvia).

The target audience included active fast-food consumers aged 18-55.

Data collection was conducted through online interviews (CAWI) with a representative distribution by gender and age.

Respondents indicated which chains they had visited during the past month and the reasons behind their choice – including location convenience, service speed, taste preferences, and brand perception.

Data analysis was based on standardized indicators of visit shares, which allowed us to create a comparative popularity index for the chains and to identify the main drivers and barriers of choice.

Vilnius: Balance of Global and Local

In the Lithuanian capital, McDonald’s remains the market leader, accounting for 51% of all visits. The second most significant player is the local chain Jammi, with 22% of visits – a unique case in the region where a domestic brand confidently competes with international giants.

Hesburger accounts for 17%, while KFC holds 8%. Burger King (2%) and Subway (1%) represent a very small share of visits. Thus, Vilnius stands out as the most diversified market – alongside global players, a strong local brand plays a visible role.

Tallinn: The McDonald’s–Hesburger Duopoly

In Estonia, the market structure is more concentrated. McDonald’s accounts for 51% of all visits, while Hesburger follows with 31%. Together, these two brands control over 80% of the market, forming an actual duopoly.

KFC attracts 11% of visits, and Burger King – 6%. There are no significant local brands in Tallinn, and Subway is absent. As a result, the market is relatively closed and heavily dependent on two dominant players.

Riga: Absolute Leadership of McDonald’s

In Latvia, McDonald’s achieves a record high – 60% of all visits, making it the most dominant brand among the three capitals.

The second largest player, Hesburger, holds 29%, reinforcing the dual-market structure.

Other chains have minimal presence: KFC (6%), Burger King (4%), and Subway (1%).

Riga practically lacks strong local alternatives, which further increases the concentration around global brands.

Consumer Preferences

McDonald’s is the undisputed choice for most residents in all three capitals. In Riga, almost two-thirds of all visits (60%) go to McDonald’s. For consumers, it symbolizes stability, a familiar taste, and a trusted global standard.

Hesburger ranks second in popularity, especially strong in Estonia (31%) and Latvia (29%). Consumers often see it as a more “Nordic” and affordable counterpart to McDonald’s.

Jammi is a unique choice for Vilnius residents – every fifth visit (22%) goes to this local brand. It reflects strong loyalty to a national network that adapts its menu to local tastes.

KFC attracts moderate interest in Vilnius and Tallinn (8-11%), mainly as an alternative to burger-based menus. Its share in Riga is noticeably lower.

Burger King and Subway remain niche options, chosen by a small segment of consumers (1–6% across the capitals).

Conclusion

In Vilnius, local identity plays a crucial role – consumers support the national brand Jammi while remaining loyal to McDonald’s.

In Tallinn, consumer behavior is driven by habit and trust, favoring the established McDonald’s and Hesburger brands.

In Riga, the market is highly concentrated around McDonald’s, where accessibility and long-standing habit are the main deciding factors.

Overall, consumer motivation across the Baltic capitals is shaped by three core drivers:

Accessibility – wide network coverage and convenience of location;

Habit – established consumption of familiar products;

Local identity – preference for and support of national brands.

Georgia

Georgia

The growing number of online shoppers and the rising frequency of orders send a clear signal to businesses: e-commerce in Georgia is gaining momentum. The main growth drivers remain young people, women, and urban residents.

Read more

Multi-country

Multi-country

In 2024, our agency conducted a study on the psychographic segmentation of consumers aged 18+ in several Central Asian and Caucasus countries. We identified key groups across various segments and formulated recommendations for their use in marketing strategies.

Read more

Georgia

Georgia

Media Consumption in Georgia is an initiative-based comprehensive study conducted as part of the “Beside 2024” project, which our company regularly implements. The goal of the study is to analyze the behavior and consumption habits of the population in relation to services and products.

Below are the key trends in media consumption across various channels.

Read more

You have successfully registered for the training. Our team of specialists will be in touch with you shortly.

Go back